Stationed in Ghana, Solution Oasis, Ltd. is a socially and environmentally conscious agro-processing company that manufactures natural skin care products from African butters, oils, and herbs for local, regional, and international markets. Since its inception in 2008, the company has successfully developed two product lines– Beauty Secrets and Exotic Man. In response to the new niche that has formed for agribusinesses to center on personal care, beauty companies are racing for market share both domestically and internationally. With international brands such as Shea Moisture and Carol’s Daughter and domestic brands like TAMA and MGL Naturals leading in brand recognition and loyalty in the Ghanaian market, Solution Oasis, Ltd. must tap into unique strategies to navigate this competitive space and differentiate itself from its competitors. This case study examines the macro-environment that Solution Oasis, Ltd. exists within with a specific focus on features of Ghana’s agricultural and agribusiness sectors. Weaving in market research conducted by the 2018 SMART Ghana team, it sets forth the company’s story, operations, and challenges, and identifies potential strategies to strengthen its marketing efforts.

Introduction

Following her participation in the Agribusiness Executive Education Program in South Africa, Francesca Brenda Opoku, CEO of Solution Oasis, Ltd., sat and reflected on the next steps for her company. Solution Oasis, Ltd., a purveyor of natural skin care products in Ghana, has had slow but steady growth over the last nine years due to increases in consumerization in Ghana and interest abroad. In the early years, having no employees, Francesca processed and assembled each product solely from the confines of her home. Since then, her company has expanded with the addition of a production site and a team of eight full-time employees and several technicians who collectively support the daily operations of the company.

The increase in consumer demand for natural skin care products has led to a saturation of skin care companies and Francesca has found it challenging to gain a competitive advantage. Although Solution Oasis, Ltd. offers a variety of products such as soaps, butter, and lotions, there are several competitors who have more diverse product lines. These competitors invest heavily in promotion, which has led Ghanaian consumers to recognize and laud their products. Coupled with the prevalence of international cosmetic ingredient buyers interested solely in the purchase of raw, unbranded materials, this influx of natural ingredients from Africa’s soil into the international cosmetic market continued to prove challenging for the company. The natural skin care industry is now crowded with competitors who must employ robust marketing strategies to grab a slice of the industry’s market share.

Knowing this, Francesca will need to examine the marketing tactics that other natural skin care companies employ which have solidified her competitors’ reputations in Ghana and across the international market. Understanding the nuances of her target consumers’ preferences will aid Solution Oasis, Ltd. in developing an action plan that identifies new opportunities for growth, fortifies the company’s brand, and successfully positions the company in local and international markets.

The Ghanaian Context

Throughout the African diaspora, Ghana is revered for its history and the role agriculture has had in it. As the first sub-Saharan African country to gain its independence in 1957, Ghana was held as a model of liberation and initiated the era of decolonization that swept West Africa throughout the following decade. Lauded as Ghana’s liberator and first President, Kwame Nkrumah ushered in this era of independence by fostering a sense of collective identity among African countries. It was Nkrumah’s goal to build a socialist society, one that was Ghanaian in character and African in outlook. To achieve these goals, he took advantage of Ghana’s early integration into the international global market and created a plan that collectivized agriculture and brought his country to economic independence.[1]

The integral role cocoa cultivation has had on Ghana’s economic evolution cannot be understated. Sourced from forested areas located in southern Ghana, cocoa is Ghana’s principal agricultural export, accounting for seven percent of the country’s GDP and twenty to twenty-five percent of total export earnings.[2] Ghana is the second largest exporter of cocoa in the world, providing over twenty percent of the global supply.[3] The success of Ghana’s $2 billion cocoa industry is largely attributed to the role the government has played in its management. Through the Ghana Cocoa Board (COCOBOD), favorable prices are ensured, marketing is improved through partial liberalization, and all this helps in the productivity of the sector.[4] In addition to cocoa, shea has recently earned international recognition as a cocoa butter substitute. Ghana is among the largest producers of shea nuts with shea butter accounting for twenty-five percent of the country’s exports. It is estimated that the industry supports, directly or indirectly, the livelihoods of over two million people in Ghana.[5]

Crops like cocoa and shea– as well as other agricultural crops like maize, kola nuts, palm oil, and timber– form the base of Ghana’s economy. In 2016, Ghana’s gross domestic product (GDP) totaled approximately $42 billion of which the agricultural sector accounted for about twenty percent.[6] [7] In 2017, following an economic decline that led to an IMF bailout in 2015, cocoa, in addition to oil and gold, surged to pull the country out of deficit.[8] Of the over thirteen and a half million people who constituted the labor force in 2017, fifty-two percent of the population were involved in agricultural production.[9] [10] According to Abraham, Ohemeng, and Ohemeng, agriculture is also a vital source of formal and informal employment for women in the labor force.[11] Shea income, for example, is the main source of income for many women living in the Northern region of the country. Their activity in the industry occurs either through wage employment or through the harvesting of shea nuts on communal parklands or privately-owned agricultural lands. Once the nuts are gathered, these women either sell the kernels or process them further into shea butter which is sold to market agents.[12]

While Ghana’s economic viability has hinged on export-oriented production of raw materials, there has recently been a move toward transforming the economy from one dependent on the export of raw materials to one that is value-added and industrialized.[13] Accompanying this shift in the country’s economic agenda, Ghana has seen an increase in the number of local agribusinesses. Solution Oasis, Ltd. is one of these local agribusinesses and specializes in the manufacturing of natural care products. As it navigates new territory where challenges– from internal communications to digital communications– have no localized precedent, the company is embracing the novelty of its hardships and has sustained itself to become an established local brand.

A Macro-Environmental Analysis of Agribusinesses in Ghana

Crafting solutions for an agribusiness such as Solution Oasis, Ltd. requires a macro-environmental analysis that considers the full panorama of societal factors which influence its operations. An assessment of national policy agendas, technological advancements, and gender-based disparities will help contextualize Solution Oasis, Ltd.’s current situation.

Driven by the need for a vibrant, sustainable agricultural sector, a number of policies implemented over the years have bolstered the efficacy of the sector. Perhaps the most impactful policy, the “one district, one factory” policy, was introduced in 2016. Starting as a campaign pledge made by current president Nana Addo Dankwa Akufo-Addo, the policy aims to put a factory in each of Ghana’s 216 districts within the next four years, and to transform the structure of the economy from one dependent on production and the export of raw materials to a value-added industrialized economy which will be driven primarily by the private sector. The president purports that this initiative will create economic growth, accelerate the development of areas where the factories are located, and create jobs for the growing youth population. Inevitably, new agribusinesses will be created and current agribusinesses will expand.[14] In addition to the policy level, technological advances have supported the work of small and medium-sized enterprises (SMEs) in the agricultural sector. With regards to mobile technology, the most popular mechanism as indicated by the SMART team’s research is mobile money. According to Essegbey & Frempong, connections between mobile and financial agencies allow businesses to attain monetary resources more quickly for their work. [15]

While a number of factors have aided the growth of agribusinesses, gender dynamics in Ghana have conversely impeded many from accessing these transformative resources. As reported by Abraham, Ohemeng & Ohemeng, although agriculture is a major source of employment for women in the labor force, gender disparities do exist.[16] Unfortunately, “for every 100 Ghanaian men accessing credit, only 47 women do.” [17] A collective understanding of these factors can inform the future direction of Solution Oasis, Ltd. and illuminate potential opportunities.

Solution Oasis, Ltd.: A Company Profile

The Story

Solution Oasis, Ltd. was born from the resilience and perseverance of Francesca Brenda Opoku, a female Ghanaian entrepreneur who is a living example of what becomes possible when women are empowered, supported, and connected. Francesca’s entrepreneurial journey began after she quit a well-paying corporate job to create Office Essentials, a marketing and printing company that specialized in the creation of personalized products and business gifts for several leading companies in Ghana. Affirmed in her ability to commodify her creativity, Francesca recognized the opportunities surrounding the Africa Cup of Nations in 2008 and used her own financial resources to create merchandise for each qualifying African nation. Unfortunately, due to unanticipated issues with the shipment, the merchandise arrived late and she missed her window of opportunity. This left her dismayed and financially crippled.

After some self-reflection, Francesca decided to pursue her college dreams of establishing Superdrug (a beauty and cosmetic shop) in Ghana. Fueled by her strong family support and her belief in the economic transformation shea can have on impoverished communities living in the Northern Region, Francesca founded Solution Oasis, Ltd., a socially conscious company that manufactures skin care products from natural butters, oils, and herbs sourced from Ghana’s abundant natural resources. Solution Oasis, Ltd. began with its Beauty Secrets line featuring cocoa butter skin products and later incorporated shea butter and black soap products. Later, Solution Oasis, Ltd. expanded to include another product line, Exotic Man, which specifically markets to the male consumer.

The company began in a small, humble way from the backyard of the CEO’s home. She organized her first products in packs of six and supplied to neighboring shops within her community. The first two big outlets in Accra to accept her products were the Baatsona Total Supermarket and Koala Supermarket. As demand for her products increased, her home became clustered with all kinds of products, measuring cups, and natural oils. In June 2010, Francesca began to search for a large-scale production site and secured one in Nsawam located about thirty-one miles from her home. At this new site, Francesca hired her first three employees: one finance manager and two factory operators. With a burning desire to give back to Tamale, a city known for its international shea industry and a community in which she was nurtured, Francesca added shea butter and black soap to her line of products. While this new site was larger and more suitable for production, the operating and administrative costs were clearly exorbitant for an infant company with limited working capital. Thus, in January 2014, with the help of her husband, Solution Oasis, Ltd. was relocated to Haatso– a proximal location from Francesca’s home. In these early years, the Haasto site was an unfinished building with no locks to protect materials and equipment. Over time, as production and sales increased, she invested in industrial doors and locks for the production site in Haatso. Today, Solution Oasis, Ltd. is comprised of a small staff of eight full-time employees and fifteen part-time workers organized into four main departments: Marketing, Finance, Production, and Administration departments with all heads reporting to Francesca as the CEO.[18]

Mission and Values

Solution Oasis, Ltd.’s mission is to “create some of the purest, most effective natural, herbal skin care products in the world; combining traditional wisdom with modern scientific processing techniques to combine the most beneficial herbs and the purest natural ingredients whilst creating community-based jobs that sustain the environment.”[19] As a socially and environmentally conscious business, the company targets oils and herbs that are ethically sourced from Africa to ensure they continuously invest in protecting the environment. Francesca believes this socially responsible mindset does not only “enhance the lives of the [people] that she works with but serves as a differentiating point for [the company] on the international market.”[20] Moreover, the company prides itself on delivering fair prices to all its stakeholders: the women who supply the natural ingredients, the employees, and all those who offer any products or services. Most importantly, Francesca emphasizes the need to offer clients premium cocoa and shea butter products at affordable prices, ensuring access to every individual irrespective of age or societal group. The company passionately aims “to become a leading manufacturer of a premium, globally identifiable brand of exquisite quality, natural skin care products sold in the local, regional and world market.”[21]

Partnerships and Networks

Much of Solution Oasis, Ltd.’s growth is attributed to strong social networks that have provided capacity-building opportunities for Francesca and her company. Francesca and her staff continue to attest to the fact that networking opportunities have been instrumental to the success of her company. With the help of partners in Ghana including the Shea Network Alliance, African Agribusiness Incubator Network, KOSMOS Innovation Centre, and the Ghana Export Promotion Authority, as well as international partners including the Food and Agriculture Organization and the Japan International Cooperation Agency, Francesca has participated in several entrepreneurial programs across Africa, Europe, the Americas, Asia, and the Middle East. These continue to create market opportunities while enhancing the business capacities, brand, and reputation of Solution Oasis, Ltd. In 2015 and 2016 respectively, Francesca participated in the African Women’s Entrepreneurship Programme (AWEP) and the Vital Voices Global Leadership Fellowship. These opportunities strengthened the internal structures of her company and positioned her business in the global market.

The Supply and Value Chain

Solution Oasis, Ltd.’s supply chain functions as part of a complex network of independent channels that contribute to the success of production. Raw materials are sourced from different regions of Ghana through market liaisons and women in cooperatives who work with farmers and women collectors respectively. During shea’s peak seasons, women collectors harvest, sort, crush, roast, mill, knead, and finally refine these natural ingredients into shea oils. The heads of these women’s cooperatives act as intermediaries who serve as quality control officers and market liaisons between the collectors and buyers. It is worth noting that heads of women’s cooperatives have become instrumental in ensuring that women do not settle for low prices (“price takers”). For cocoa, farmers harvest and supply the cocoa pods directly to the Ghana Cocoa Board for processing and distribution to buyers. Over the years, Solution Oasis, Ltd. has partnered with different women’s cooperatives and subsidiaries of the Ghana Cocoa Board for its primary raw materials. Other secondary raw materials, including palm kernel, henna leaf powder, baobab leaf powder, neem oil, moringa powder, and coconut oil, are also sourced on a smaller scale from different intermediaries across the country. Raw materials are supplied periodically to the company’s production site via public transportation. Once raw products are obtained at the company’s site, oils are extracted, processed, and combined with other fragrances through fractionators and refiners. The different products are then tested by the technicians for quality.

Solution Oasis, Ltd.’s value chain constitutes a wide range of activities that are necessary to transform raw materials (shea nuts and cocoa pods) into end products (soaps, lotions, gels, etc.) for consumers. Across the value chain, different actors collaborate to satisfy the market demand and ensure that value is added to the product from sourcing to distribution. The success of each product depends on the authenticity, cooperation, and effectiveness of both internal and external players. Within the firm, the management team serves as the backbone of the company by maximizing the value of the firm’s product through daily operations, logistical support, as well as marketing and sales activities. Externally, upstream workers (farmers and shea collectors) and intermediary market liaisons are well positioned to sell these raw oils and butters to Solution Oasis, Ltd.’s production site for value proposition.

Impact

Francesca defines Solution Oasis, Ltd. as a people-centric company that is invested in the betterment of all agents acting within its supply and value chains. By sourcing their raw ingredients from the Northern, Eastern, and Central regions of Ghana, the products Solution Oasis, Ltd. sells have a trickle-down effect on the women who collect, knead, and mill shea nuts, as well as other farmers who provide coconut and palm oil. Francesca’s commitment to paying fair prices ensures that all agents within the supply chain benefit from Solution Oasis, Ltd.’s endeavors. Conversations with farmers and cooperative leaders in the Northern Region reveal that the transactions between such women’s cooperatives and Solution Oasis, Ltd. have contributed to the improvement of their livelihoods.

Solution Oasis, Ltd. also makes a conscious effort to positively affect youth and its employees daily. For the young workers in production, a flexible schedule is created so that they work over weekends and vacations in order to save some money towards school expenses. Additionally, the finance manager has instituted an informal savings mechanism for young workers. He tracks their academic performance and rewards those who have excelled. Some workers are also given salary advances if there is a need to pay for crucial and imminent school expenses. Francesca also incentivizes her long-term staff by treating them when business is going well, paying them on time, and providing additional company benefits. All staff members also enjoy monthly allowances and a monthly supply of Solution Oasis, Ltd. products.[22]

Examining Solution Oasis, Ltd.’s Marketing Strategy

In order to increase demand for its products, Solution Oasis, Ltd.’s strategy consists of a number of marketing tools. Using findings from market research, an assessment of the company’s products, pricing, place (or distribution), and promotion policies was completed to assist in future marketing plans and execution.

Products: There are currently two brands under Solution Oasis, Ltd.– Beauty Secrets and the recently released Exotic Man. Exotic Man was added to target males whose needs had not been fully met in the Ghanaian skin care industry. Finished products are packaged and branded appropriately into butters (creams, moisturizers, and lotions) and soaps (gels and tablets) in different sizes and quantities. Products are made available domestically or internationally through various outlets and media. Products sold internationally are either branded or sold blindly, depending on the contract between the company and the distributor. To create a brand that targets new customers with relatively higher buyer reservation prices, the management of Solution Oasis, Ltd. is considering a new premium line, Kipenzi (which means Adorable or Beautiful in Swahili). According to market research, natural hair products are as a potential niche market for Solution Oasis, Ltd.

Price: At Solution Oasis, Ltd. pricing is determined by analyzing the cost of production, profit margins, and competitor prices. In particular, the costs of production can be expensive for the organization as Solution Oasis, Ltd. needs to account for the cost of imported bottles and containers. However, across different markets and agencies, Francesca practices good price elasticity and differentiation tactics to ensure that she offsets some of her costs in the long run. Compared to the local and regional competitors, Solution Oasis, Ltd.’s price points are at the lower end of the spectrum. The company maintains an affordable price point that is fair to suppliers, outlets, and customers.

Placement: The majority of Solution Oasis, Ltd.’s products are sold in the local Ghanaian market. Solution Oasis, Ltd. distributes its products to dozens of outlets in the Greater Accra region, specifically supermarkets, cosmetic shops, pharmacies, gift shops, gas station stores, and duty-free shops. However, due to irregular stocking mechanisms, the company is not able to track low stocks in these outlets effectively. Moreover, some individual customers also travel to its main office in Haatso to buy directly from the production site. Products are tailored towards lower and middle-class Ghanaians. To accomplish its goal of being a global manufacturer of skin care products, the company also exports to markets in Africa, the United States, and the Caribbean. Across the African continent, Solution Oasis, Ltd. products are largely exported to Nigeria, Liberia, and Kenya, with smaller distributions to Zambia, Namibia, and South Africa. For example, though the pricing mechanisms in Liberia and Nigeria are good, the company only supplies low volumes of its products in these countries. Likewise, the CEO recalls that regional restrictions and regulations across some African countries inhibit shipment and expansion possibilities. Francesca highlights that, while her international market base represents a small percentage of her profit margin, there is a lot of potential to grow as many customers are interested in natural skin care products. However, she recognizes that the strict entry requirements in other regions such as the European Union (EU) zone may not be suitable for a business as small as Solution Oasis, Ltd.

Promotion: Promotion is a major challenge for Solution Oasis, Ltd. Currently, the company invests in print advertising such as brochures and flyers. These are distributed to potential customers either at the supply source or through outlets and are an effective way for Solution Oasis, Ltd. to advertise their product offerings. Currently, the brochures and flyers only market Beauty Secrets products to women specifically. Additionally, the company has in the past utilized radio advertising with one of the biggest multimedia houses in the country, JOY FM. As most people listen to the radio when they are on the road, this is also an effective avenue to reach many demographics at once. However, to date, Solution Oasis, Ltd. has used radio advertisement fairly minimally. The company also has Facebook, Twitter, Instagram, and YouTube accounts. These social media accounts are by far the cheapest and most effective way to advertise to thousands of people around the world at nearly zero cost. Social media advertising can be incredibly advantageous for a growing company like Solution Oasis, Ltd. to differentiate themselves from competitors, especially when competing in a fairly saturated skin care market. Unfortunately, social media is underutilized by the company. Solution Oasis, Ltd. also has a website where their products are featured. Websites are another way to reach a wide variety of consumers and to help educate the public about Solution Oasis, Ltd.’s mission, process, and story. However, this website is also underutilized, and the company has the potential to create greater promotional opportunities through this avenue.

Weighing the Competition

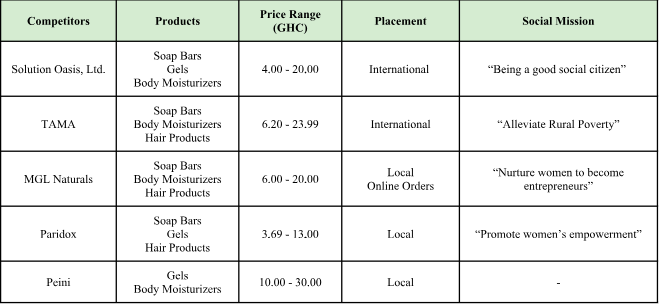

Solution Oasis, Ltd. faces competition from a variety of small and medium enterprises across the country.[23] All of these competitors specialize in creating skin care products sourced from natural ingredients and methods. Given the government’s emphasis on promoting “Made in Ghana” products to improve the production, processing, and distribution of raw materials, the main natural ingredients used by both Solution Oasis, Ltd. and its competitors is shea and cocoa– two staple commercial crops in Ghana.[24] Each company creates additional value by incorporating different ingredients such as coconut oil, argan oil, baobab oil, and more sources from other regions in the country. Market analysis has indicated that out of many brands available on the Ghanaian market, Ghanaians hold strong preference for four of these brands– TAMA, MGL Naturals, Paridox, and Peini– due to their price points, premium packaging which reflects their respective social missions, variation of products, purported skin benefits, ingredients, and attainment of brand name loyalty .[25] Information related to the products, pricing, promotion, and placement of each competitor is listed below.

Figure 1: Competitor Analysis (Cornell SMART Market Research Study 2018)

Naming the Challenges

Capital Acquisition

Solution Oasis, Ltd.’s biggest challenge is acquiring sufficient financial capital to keep the business operating smoothly while meeting all other financial obligations. Similarly, many agribusiness owners in Ghana remain cut off from accessing financial systems. Both public and private financial sector institutions “lend a disproportionately lower share of their loan portfolios to agriculture compared to agriculture sector’s share of GDP.” [26] Agribusinesses are poorly financed because they tend to be riskier and incur higher transaction costs compared to other businesses.[27] Moreover, in most cases, agribusiness owners lack succession plans and long-term goals to convince investors that they can sustain their companies for many years. This was emphasized by Richard Kwarteng Ahenkorah (Managing Director of AllTime Finance) during the SMART tram’s market research; agribusinesses in Ghana such as Solution Oasis, Ltd. can garner financial support efficiently if owners legitimize their companies as organized business structures instead of recreational ones.[28]

Digital Divide: Online Communications and Social Media

A potential challenge that Solution Oasis, Ltd. will have to overcome is the lack of continuity in their online communications. Solution Oasis, Ltd.’s greatest appeal to consumers lies in both their story and their social impact, neither of which are being communicated through any of their online platforms. Although Solution Oasis, Ltd. has a Marketing Manager, this individual is not properly trained in social media marketing. It will be a challenge for them to receive training and grow accustomed to the new strategy. Additionally, the website is currently being managed by Francesca’s son who lives in the United States. He is both physically distant and unable to allocate a significant amount of time to the website given that he already works a separate full-time job. Training a member of Francesca’s team in Accra will be essential for the website’s upkeep. Another marketing problem for Solution Oasis, Ltd. is that their visual content is severely limited. To address this, members of Francesca’s team would need the ability to take unique pictures of their products in order to bolster promotions. The marketing strategy mentioned previously will help mitigate this issue, but it will take time before Solution Oasis’s online image can be completely renovated.

Opportunities for Growth

Market Expansion

The increase in awareness about natural skin care coupled with a simultaneous growth in the Ghanaian tourism industry presents a unique opportunity for Solution Oasis, Ltd. As the “translocalism” trend grows, market research indicates that hotels have begun incorporating local culture into the guest experience through locally-inspired design, décor, food, and uniforms. Some hotels in Accra have even upgraded their complementary skin care products (such as soaps and lotions) to natural products sourced from locally-owned businesses. Currently, Solution Oasis, Ltd. does not have any partnerships with hotels to market its products.

Product Diversification

Many natural skin care lines have incorporated hair products into their brand lines to meet the growing interest in maintaining natural hair (free of relaxers or other chemical products). This burgeoning market is evidenced by a study which found Ghanaian salons to be losing consumers because they are reluctant to put unnatural substances in their hair.[29] Admittedly, Solution Oasis, Ltd. has offered hair products in the past. By reconsidering this idea, the company can assess its previous successes and failures in making hair products and come up with a reformed product that will appeal to the ever-growing desire for natural hair in Ghana.

Packaging

Market research also indicated that one major shortcoming of local natural skin care companies is poor packaging. Survey respondents highlighted that products come in mundane plastic containers. Research in Ghana has demonstrated that upgrading packaging can bring about greater earnings for companies.[30] Hence, Solution Oasis, Ltd. can strengthen its approach by: 1) making labels more legible, 2) adding the founder’s story, or 3) including the company’s social mission to add more meaning to each purchase.

In the last nine years, Solution Oasis, Ltd. has offered its clients premium natural skin care products containing ingredients sourced from Ghana. The company has also expanded its market reach by targeting domestic, regional, and international customers to maintain its aim of being a global company by 2025. After assessing the current competitive outlook and the market research study, Francesca is certain that she needs to apply robust marketing strategies to maintain the reputation and value of Solution Oasis, Ltd. in the local and international natural skin care industries. New and existing players are offering differentiated products to position themselves in new segments of the markets. Such competitors are also exploring new marketing avenues to boost brand awareness and visibility among customers. In order to sustain their operations, Solution Oasis, Ltd. must adopt new marketing strategies to surmount the existing competition in the local and international skin care industries.

This research was made possible through the support of the Student Multidisciplinary Applied Research Team (SMART) program within the Emerging Markets Program (EMP) in the Charles H. Dyson School of Applied Economics and Management at Cornell University. Many thanks to Francesca Brenda Opoku (CEO of Solution Oasis, Ltd.), her staff and partners, and other stakeholders who hosted and supported the Student Multidisciplinary Applied Research Team (SMART) in Ghana.

References

- Beckman B. (1981) Ghana, 1951–78: the Agrarian Basis of the Post-colonial State. In: Heyer J., Roberts P., Williams G. (eds) Rural Development in Tropical Africa. https://doi.org/10.1007/978-1-349-05318-6_6. ↑

- Kolavalli, S. and Vigneri, M. (2011) Cocoa in Ghana: shaping the success of an economy. http://siteresources.worldbank.org/AFRICAEXT/Resources/258643-1271798012256/Ghana-cocoa.pdf. ↑

- Ibid. ↑

- Ibid, ↑

- Al-hassan, S. (2015) Ghana’s Shea Industry: Knowing the Fundamentals. Tamale, Institute for Continuing Education and Interdisciplinary Research, UDS. http://udsspace.uds.edu.gh/jspui/bitstream/123456789/1206/1/GHANA%E2%80%99S%20SHEA%20INDUSTRY%20KNOWING%20THE%20FUNDAMENTALS.PDF. ↑

- Food and Agriculture Organization of the United States. (2005) Fertilizer use by crop in Ghana. http://www.fao.org/docrep/008/a0013e/a0013e06.htm. ↑

- Trading Economics. (2018a). Ghana GDP. https://tradingeconomics.com/ghana/gdp. ↑

- World Bank. (2017) Ghana – overview. The World Bank Group. http://www.worldbank.org/en/country/ghana/overview. ↑

- Food and Agriculture Organization of the United States. (n.d) FAO in Ghana. Available from: http://www.fao.org/ghana/fao-in-ghana/en/. ↑

- Trading Economics. (2018b) Ghana- labor force, total. https://tradingeconomics.com/ghana/labor-force-total-wb-data.html. ↑

- Abraham, A.Y., Ohemeng, F.N.A. & Ohemeng, W. (2017) Female labour force participation: evidence from Ghana. International Journal of Social Economics. 44(11), 1489-1505. Available from: https://doi.org/10.1108/IJSE-06-2015-0159. ↑

- Al-hassan, S. (2015) Ghana’s Shea Industry: Knowing the Fundamentals. Tamale, Institute for Continuing Education and Interdisciplinary Research, UDS. http://udsspace.uds.edu.gh/jspui/bitstream/123456789/1206/1/GHANA%E2%80%99S%20SHEA%20INDUSTRY%20KNOWING%20THE%20FUNDAMENTALS.PDF. ↑

- One District, One Factory. (2017) The process. Available from: http://1d1f.gov.gh. ↑

- One District, One Factory. (2017) The process. Available from: http://1d1f.gov.gh. ↑

- Essegbey, G.O. & Frempong, G.K. (2011) Creating space for innovation—The case of mobile telephony in MSEs in Ghana. Technovation. 31(12), 679-688. https://doi.org/10.1016/j.technovation.2011.08.003. ↑

- Abraham, A.Y., Ohemeng, F.N.A. & Ohemeng, W. (2017) Female labour force participation: evidence from Ghana. International Journal of Social Economics. 44(11), 1489-1505. Available from: https://doi.org/10.1108/IJSE-06-2015-0159. ↑

- Curtis, M. (2013) Improving african agriculture spending: budget analysis of Burundi, Ghana, Zambia, Kenya and Sierra Leone. http://www.africa-adapt.net/media/resources/888/improving-african-agriculture-spending-2.pdf. ↑

- Opoku, Francesca. Cornell University 2018 SMART Ghana team. Informational Interview. Haatso, Ghana, January 2018. ↑

- Opoku, Francesca. Cornell University 2018 SMART Ghana team. Informational Interview. Haatso, Ghana, January 2018. ↑

- Opoku, Francesca. Cornell University 2018 SMART Ghana team. Informational Interview. Haatso, Ghana, January 2018. ↑

- Opoku, Francesca. Cornell University 2018 SMART Ghana team. Informational Interview. Haatso, Ghana, January 2018. ↑

- Opoku, Francesca. Cornell University 2018 SMART Ghana team. Informational Interview. Haatso, Ghana, January 2018. ↑

- Cornell SMART Market Research Study, 2018. ↑

- Government of Ghana. (2016) Made-in-Ghana campaign policy launched/ambassadors unveiled. http://www.ghana.gov.gh/index.php/media-center/news/3140-made-in-ghana-campaign-policy-launched-ambassadors-unveiled. ↑

- Cornell SMART Market Research Study, 2018. ↑

- World Bank. (2018) Agriculture finance & agriculture insurance. The World Bank Group. http://www.worldbank.org/en/topic/financialsector/brief/agriculture-finance. ↑

- Byerlee, D., Garcia, A. F., Giertz, A., Palmade, V. & Palmade, V. (2013) Growing Africa – unlocking the potential of agribusiness : main report (). The World Bank. Report No, 75663. http://documents.worldbank.org/curated/en/327811467990084951/Main-report. ↑

- Cornell SMART Market Research Study, 2018. ↑

- Kwei, R. T. (2018) Why Ghana’s natural hair fashion is bad for business. http://www.bbc.com/news/world-africa-42546620. ↑

- Adom, D., Yeboah, A., Saeed, A. & Amponsah M. (2017) Mobilization of the sales of products in Ghana through effective packaging. The International Journal of Science and Technology. 5, 138-144. Available from: https://doi.org/10.6084/m9.figshare.5017244.v1. ↑